Financial Advisors Illinois - Questions

Excitement About Financial Advisors Illinois

Table of ContentsThe smart Trick of Financial Advisors Illinois That Nobody is DiscussingGet This Report about Financial Advisors IllinoisThe Ultimate Guide To Financial Advisors IllinoisNot known Facts About Financial Advisors IllinoisTop Guidelines Of Financial Advisors IllinoisThe Best Guide To Financial Advisors IllinoisThe smart Trick of Financial Advisors Illinois That Nobody is DiscussingFinancial Advisors Illinois Can Be Fun For EveryoneRumored Buzz on Financial Advisors Illinois

They will check out both your finances and at the market to make certain that your financial investments are well thought out and will certainly even offer advice on where to invest based upon what their information says. Taxes get especially complicated if you own a service or have a great deal of financial investments.They will certainly additionally show you where you can save money when spending for tax obligations. Different sorts of financial investments influence your funds in different ways. Below are a couple of instances: Increases odds of multiplying your spent resources Deals higher income and even more stable pricing in slumps than bonds Help in paying for unforeseen requirements Helps fund possibilities throughout recessionsTo discover more about the benefits and drawbacks of purchasing each of these kinds, Delta Wealth Advisors provides more information here.

The benefits of making use of a monetary consultant noise well and good, but what should you consider when deciding whether to work with one? Is the cash. A basic general rule is that you need to have $100,000 in assets if you intend on working with a financial consultant. This number can range from $50,000-$1,000,000.

At Delta Wide Range Advisors, we think about ultra-high internet worth people anyone with $10,000,000 or more, however we will certainly additionally deal with HENRYs that have the potential to make that much in liquid possessions. If you desire a high return on investment, you will wish to make certain that you know what your choices are and just how much you ought to invest without being either also conservative with your money or investing way too much and placing your funds at risk.

The Basic Principles Of Financial Advisors Illinois

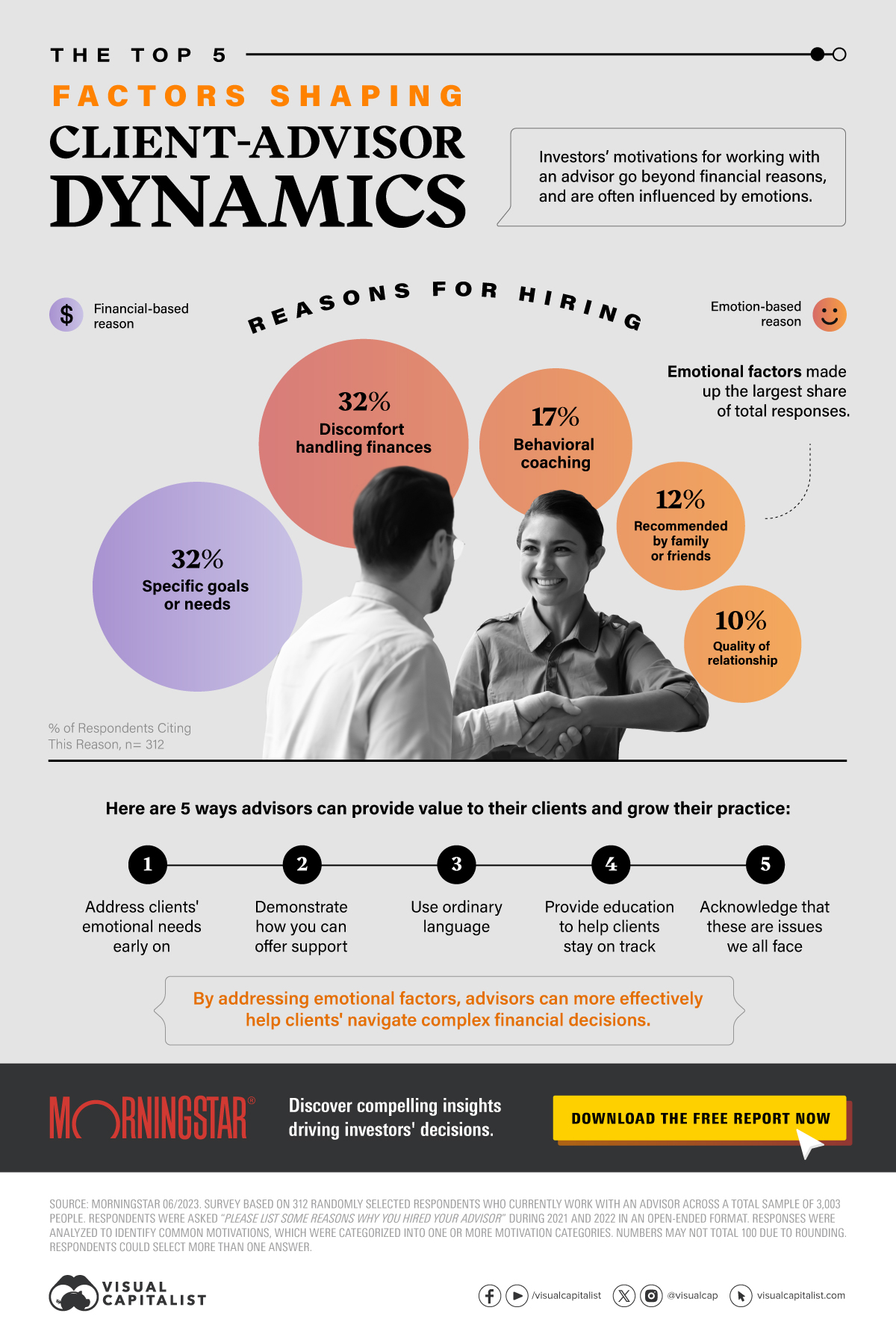

Allow information drive your choices instead of your emotions. In the long-run, data is more trusted than emotions. Employ a financial consultant to provide you the information you need to make accountable decisions. If you wish to maintain your current quality of life right into retirement, you will certainly require to make certain you have actually adequate cash conserved to do so.

In various other districts, there are guidelines that need them to fulfill certain needs to utilize the monetary advisor or economic organizer titles. What sets some financial experts apart from others are education, training, experience and credentials. There are several designations for monetary consultants. For financial coordinators, there are 3 common classifications: Certified, Individual and Registered Financial Planner.

Those on income may have an incentive to promote the product or services their companies supply. Where to locate a financial advisor will certainly rely on the type of guidance you require. These establishments have personnel that might assist you understand and purchase certain sorts of investments. Term deposits, assured investment certifications (GICs) and mutual funds.

About Financial Advisors Illinois

They may supply advice or might be registered to offer monetary items. Ask concerns to analyze whether an economic advisor has the ideal certifications.

The benefits of functioning with an economic expert below come to be clear. Especially an independent financial consultant offers a special collection of advantages that can have a large effect on your financial wellness.

These experts are skilled in different economic domains, including financial investments, retirement preparation, tax reduction, and estate preparation, giving notified support tailored to one's one-of-a-kind circumstance. Additionally, independent monetary counsellors stay upgraded on current economic market developments, investment possibilities, and legal modifications. This makes sure that receives prompt and pertinent suggestions, empowering them to make educated choices concerning their financial future.

The benefits of a monetary counsellor actually stick out in this situation. Independent advisors make the effort to comprehend one's distinct needs and aspirations to develop a financial technique that remains in line with the objectives. A neutral economic consultant can develop a customized strategy that maximises one's opportunities of success, whether one is attempting to create wide range, preparing for a significant acquisition, or saving for retirement.

Financial Advisors Illinois Things To Know Before You Get This

Managing cash isn't practically savingit's about making clever, tactical choices that establish you up for lasting success. From investment management and tax obligation preparation to retirement techniques and estate preparation, riches monitoring aids bring quality and self-confidence to your monetary future. Numerous individuals assume they can handle it all on their own, however research studies reveal that collaborating with a financial expert can lead to much better economic decisions and lasting wealth development.

So, is wealth management worth it? Let's discover the real roi. Comprehensive riches monitoring includes whatever from picking investments to preparing for future tax responsibilities. An essential component is producing a detailed financial plan that resolves all elements of your economic requirements. It additionally includes making prepare for just how your estate will certainly be dealt with and guaranteeing you have sufficient money when you retire.

Riches supervisors provide strategic support to aid you browse investment difficulties and make educated decisions. A riches manager chooses supplies, bonds, and other financial investments that match your economic objectives. They use their abilities to expand your money. This consists of understanding when to get or sell possessions. It's a crucial component of wealth monitoring services.

The Ultimate Guide To Financial Advisors Illinois

This can save you time and stress and anxiety. They consider your monetary scenario all at once. This includes financial investments, earnings, and deductions. By doing this, they craft certain tax strategies that line up with your objectives. A great strategy might even boost your web worth over time. Excellent tax obligation preparation is essential for preserving wealth.

It aids you decide what takes place to your assets after you pass away. You'll desire to produce a will, which describes just how to disperse your residential or commercial property. This can consist of homes, cash, and personal things. Counts on are also valuable tools in estate planning. They allow you hand down assets while limiting taxes that heirs may pay.

It helps you conserve for the future. A monetary coordinator can help produce a retirement strategy that fits your requirements by looking at your current monetary scenario and future goals.

The Greatest Guide To Financial Advisors Illinois

Understanding these prices is essential to deciding if wealth management is appropriate for you. Financial consultants usually bill a cost based on a portion of assets under administration (AUM).

These costs cover their services, like investment choices and detailed financial planning. As your riches expands, so does the expert's earnings. Recognizing AUM assists you read this post here examine whether hiring a wealth manager is worth it for your economic objectives.

For those with complex financial circumstances, regular advice from a wide range manager may be worth considering also. An economic consultant can improve your financial savings and investments.

Recognizing that a specialist expert exists can make difficult decisions easier. Many individuals locate convenience in having a professional overview them with their distinct economic requirements. All natural financial planning considers your entire financial life. It connects all components of your financial resources, like financial investments, taxes, and retirement. A wealth manager can help develop a complete strategy that matches your requirements.

More About Financial Advisors Illinois

Comprehensive wealth administration encompasses everything from selecting financial investments to intending for future tax obligation obligations. A key component is creating a detailed monetary strategy that resolves all facets of your financial demands.

Riches managers give calculated guidance to help you browse investment obstacles and make notified choices. A wealth supervisor chooses stocks, bonds, and various other investments that match your economic goals.

They look at your financial situation as a whole. This consists of investments, income, and reductions. Good tax preparation is crucial for protecting wide range.

Little Known Questions About Financial Advisors Illinois.

It aids you save for the future. A monetary organizer can help create a retired life plan that fits your demands by looking at your existing financial situation and future objectives.

Wide range monitoring expenses can differ extensively. You may pay a portion of your properties, level charges, or hourly prices. Each structure has its advantages and disadvantages. Recognizing these expenses is essential to deciding if wide range administration is right for you. Financial experts often bill a charge based on a percentage of assets under administration (AUM).

Not known Factual Statements About Financial Advisors Illinois

These costs cover their services, like investment choices and thorough financial preparation. As your wide range grows, so does the consultant's income. Recognizing AUM aids you assess whether working with a wide range manager is worth it for your financial goals.

For those with click here to find out more complex financial situations, normal advice from a wealth manager may be worth considering too. A monetary consultant can increase your savings and website link financial investments.

Numerous individuals locate comfort in having a professional overview them via their distinct financial requirements. Holistic monetary preparation looks at your whole economic life.